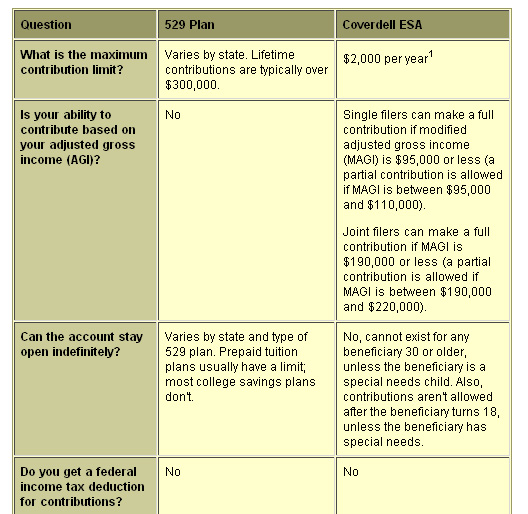

529 Plans vs. Coverdell Education Savings Accounts

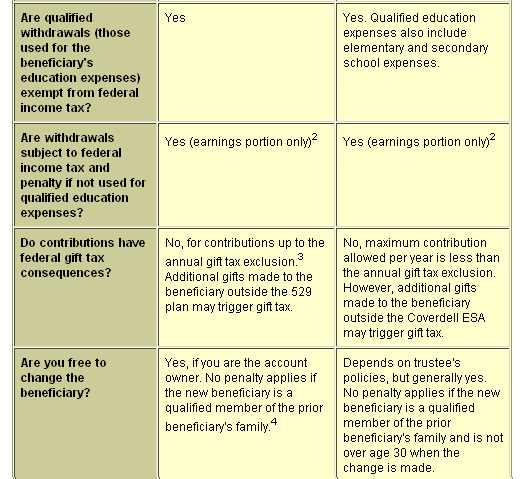

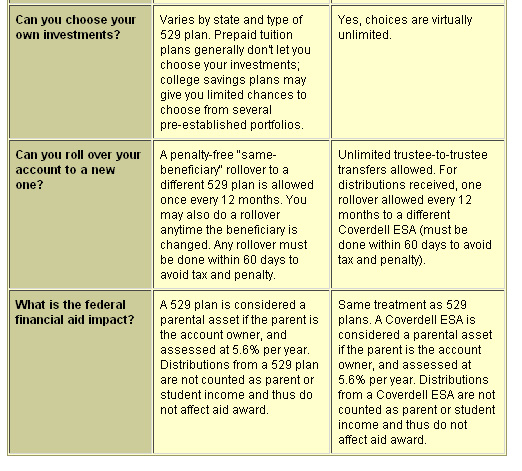

1 The provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001 that raised the annual contribution limit for Coverdell ESAs to $2,000 will expire on December 31, 2010. Unless Congress extends the law, after December 31, 2010 the annual contribution limit for Coverdell ESAs will revert to $500, the limit in effect prior to January 1, 2002.2 A 10% federal penalty is assessed on the earnings portion of all nonqualified withdrawals from a 529 plan and a Coverdell ESA. The penalty generally doesn't apply to nonqualified withdrawals made due to the beneficiary's death, disability, or receipt of a tax-free scholarship (to the extent of the scholarship's value). 3 The annual gift tax exclusion is currently $13,000. However, you may contribute up to $65,000 to a 529 plan in one year (for the same beneficiary) and not owe gift tax if you elect to spread the gift over a five-year period and you make no additional gifts to the beneficiary during that period. 4 Qualified family members include children and their descendants, stepchildren, siblings, stepsiblings, parents, stepparents, nieces, nephews, aunts, uncles, first cousins, and in-laws of the original beneficiary. Investors should consider the investment objectives, risks, charges and expenses associated with 529 plans carefully before investing. More information about 529 plans is available in the issuer's official statement, which should be read carefully before investing. Also, before investing, consider whether your state offers a 529 plan that provides residents with favorable state tax benefits. The availability of the tax or other benefits mentioned above may be conditioned on meeting certain requirements.

|